The Energy Crunch No One Is Talking About

AI Is Driving a New Energy Crisis —

And Uranium Is Back at the Center of It

Artificial intelligence is quietly rewriting the global energy equation.1

Across North America, massive new data centers are being built to support AI models, cloud computing, and high-performance workloads. These facilities don’t just consume electricity — they demand constant, reliable baseload power, 24 hours a day. And that is putting unprecedented strain on already-fragile power grids.

Stock Information

OTC: RRUUF

CSE: RUU

Sign up to receive the latest news.

Wind and solar help meet growing electricity demand, but they aren’t designed to deliver uninterrupted power around the clock. When grids need constant, 24/7 reliability — especially at the scale required by AI data centers — utilities turn to nuclear energy, one of the few proven sources of dependable baseload power.2

Once sidelined, nuclear is now re-emerging as a cornerstone of long-term energy security.

Why Uranium Is Back in Focus

Every nuclear reactor runs on uranium — and securing that fuel has become a strategic priority.3

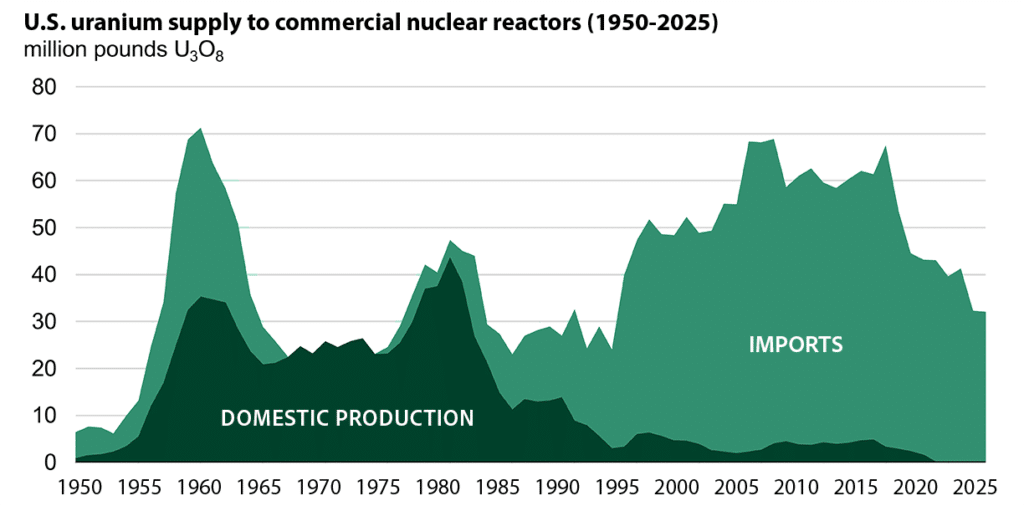

The United States imports the majority of its uranium supply, with key parts of the global fuel cycle tied to geopolitically sensitive regions. In response, uranium has been formally recognized as a critical mineral, and nuclear power has been elevated to a national energy and security priority5 — prompting utilities and governments alike to move aggressively toward securing domestic and allied supply chains.

This isn’t a short-term trade. Uranium projects take years to permit, develop, and bring into production.6 That long timeline favors companies that already control advanced assets in stable jurisdictions.

And it’s why investors are starting to pay attention to companies like Refined Energy Corp. (OTC: RRUUF | CSE: RUU)

Policy Tailwinds Are No Longer Subtle

Uranium and nuclear power are no longer fringe policy topics — they are now embedded in national energy and security planning. With the United States heavily dependent on foreign uranium and enrichment services, policymakers have formally classified uranium as a critical mineral and reaffirmed nuclear energy as essential baseload infrastructure.7 This reflects a broader recognition that reliable, domestic power generation is foundational to economic stability, national security, and technological leadership

Unlike short-cycle energy solutions, nuclear operates on decades-long planning horizons. That reality has pushed governments to focus not just on reactors, but on the entire fuel supply chain — from mining and conversion to long-term availability of uranium sourced from stable, allied jurisdictions. The objective is clear: reduce exposure to geopolitically sensitive suppliers and ensure uninterrupted fuel access for existing and future reactors.

What This Means for Uranium Assets

This policy shift has tangible consequences for the uranium market. Utilities are increasingly prioritizing long-term contracts over spot purchases, while governments emphasize supply resilience over lowest-cost sourcing. In an industry where permitting and development timelines stretch for years, this favors companies that already control advanced or well-located uranium assets — particularly those in tier-one jurisdictions aligned with Western supply chains.

As energy security, grid stability, and industrial competitiveness converge, uranium assets are being evaluated through a more strategic lens. The result is a market environment where optionality, jurisdiction, and timing matter as much as near-term production. For investors, this policy backdrop helps explain why uranium is re-entering the conversation — not as a speculative theme, but as a long-cycle infrastructure necessity.

A Different Kind of Uranium Opportunity

Rather than promising near-term production targets or aggressive timelines, some companies offer something more valuable in today’s market: strategic leverage.

- Leverage to rising uranium prices.

- Leverage to utility contracting cycles.

- Leverage to long-term energy policy shifts.

This shifting policy and energy landscape is why investors are taking a closer look at companies like Refined Energy Corp. (OTC: RRUUF | CSE: RUU)

Rather than chasing near-term production headlines, Refined Energy offers exposure to a uranium asset portfolio positioned in a tier-one jurisdiction — aligned with the growing focus on domestic and allied supply security.

As governments reinforce nuclear’s role in long-term energy planning and utilities move to secure fuel years in advance, assets like these can gain strategic relevance well before development milestones are reached.

Why Timing Matters Now

Uranium markets don’t move overnight. They tighten slowly, then suddenly.

With AI accelerating power demand, utilities returning to long-term contracts, and supply constrained by years of underinvestment, the setup today looks very different than it did just a few years ago.

For investors looking ahead — not backward — this is why uranium is back on the radar.

The Next Phase of Nuclear Growth: Small Modular Reactors

That shift in timing and urgency is also reshaping how nuclear power is expected to grow.

Leaders at the forefront of artificial intelligence have been unusually direct about one reality: advanced computing will require vast amounts of reliable power.

Sam Altman has publicly acknowledged the need for enormous quantities of nuclear energy to support AI development,9 while Elon Musk has echoed the view that nuclear power is essential for a technology-driven future.10

Similar signals have come from major technology companies exploring nuclear-powered solutions for next-generation infrastructure.

These statements matter not because they are endorsements of any one company — but because they reflect how seriously nuclear power is now being viewed by the industries driving global electricity demand.

Why Governments Are Focusing on SMRs

As demand accelerates, governments and utilities are increasingly looking toward small modular reactors (SMRs) as a practical way to expand nuclear capacity.11

SMRs are designed to be smaller, more flexible, and easier to deploy than traditional reactors.12 Their modular design allows components to be manufactured off-site and brought online incrementally — helping reduce complexity and shorten development timelines. For regions facing grid constraints, industrial expansion, or data-center growth, SMRs offer a way to add dependable baseload power without waiting decades.

This is why SMRs are now a central part of long-term nuclear planning across multiple countries.

Why This Still Comes Back to Uranium — and Refined Energy

While reactor designs evolve, the fuel requirement does not. Every nuclear reactor — traditional or modular — depends on uranium.

As nuclear capacity expands to meet AI-driven demand, long-term fuel security becomes even more critical. This reinforces the strategic value of uranium assets located in stable, Western jurisdictions — particularly those aligned with future reactor deployment and long-duration supply needs.

This is where Refined Energy Corp. (OTC: RRUUF | CSE: RUU) comes into focus. The company offers exposure to uranium assets positioned for a market where nuclear power — including SMRs — plays a growing role in global energy systems. As policy support strengthens and new reactor technologies move closer to deployment, access to secure uranium supply remains a foundational requirement.

The Asset at the Center of the Story: Dufferin

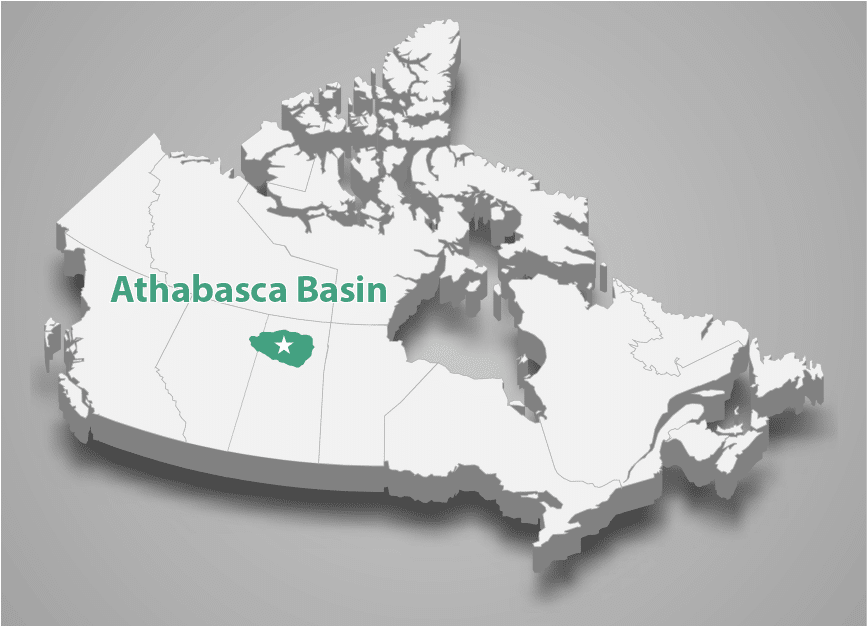

Refined Energy Corp. controls uranium assets in one of the most important mining districts in the world: the Athabasca Basin in northern Canada.13

This region is widely regarded as the premier uranium jurisdiction globally, known for deposits that are orders of magnitude higher grade than the world average. In fact, the Athabasca Basin hosts many of the highest-grade uranium mines ever developed, including the Cigar Lake and McArthur River mines, the world’s largest high-grade uranium operations, as well as long-producing mines such as McClean Lake.14

Within this prolific district sits Refined Energy’s flagship Dufferin Project.

Why Dufferin Stands Out

The Dufferin Project consists of two non-contiguous land packages — Dufferin North and Dufferin West — positioned near known high-grade mineralization, underscoring the geological pedigree of the area.

Just as important as geology is jurisdiction. The Athabasca Basin is located in Canada, offering regulatory stability, established infrastructure, and alignment with Western energy and security priorities. At a time when governments are focused on securing uranium supply from allied nations, this location carries strategic weight.

As Mark Fields, CEO of Refined Energy Corp., has stated:

Why Now: Uranium’s Setup Is Structurally Different

With a flagship uranium asset already positioned in the Athabasca Basin, the remaining question for investors is timing

1. Energy Demand Is Rising — and Nuclear Is Central to the Response

Global electricity demand is accelerating, driven by energy-intensive industries such as artificial intelligence, advanced computing, electrified transportation, and digital infrastructure. In response, governments are moving beyond short-term solutions and recommitting to nuclear power as dependable, long-duration baseload energy.

Dozens of countries have now articulated plans to expand nuclear capacity over the coming decades.15 Because uranium is the essential fuel for every reactor, this shift directly translates into sustained, long-term demand for uranium — not just incremental growth, but structural expansion.

2. Uranium Is One of the Tightest Major Commodity Markets

Unlike many industrial metals that can respond quickly to higher prices, uranium supply is constrained by long development timelines, regulatory hurdles, and years of underinvestment. As a result, uranium prices have strengthened while inventories tighten — a dynamic that sets uranium apart from more cyclical commodities.16

With utilities increasingly prioritizing long-term contracts over spot purchases, the uranium market is being shaped by forward-looking demand rather than short-term speculation. That backdrop favors assets already located in proven, secure jurisdictions.

3. Location Matters — Especially in the Athabasca Basin

Jurisdiction and geology are critical in uranium investing. The Athabasca Basin in northern Canada is widely regarded as the world’s premier uranium district, hosting many of the highest-grade uranium deposits ever discovered.

Refined Energy Corp.’s Dufferin Project is located within this basin. In an environment where new discoveries are rare and development timelines are long, scale and location significantly enhance strategic value.

4. SMRs Expand the Demand Profile, Not Replace It

Small modular reactors are accelerating nuclear deployment by offering flexibility and faster build timelines — but they still rely on uranium as fuel. As SMRs supplement traditional reactors, the number of operating nuclear units globally could increase, reinforcing uranium demand rather than displacing it.

This evolution strengthens the long-term case for uranium assets aligned with Western reactor deployment and fuel security.

5. Strategic Assets Attract Strategic Interest

Historically, uranium assets in tier-one jurisdictions have drawn interest from larger industry players seeking to secure future supply. As energy security rises on government and utility agendas, well-located uranium projects with meaningful scale are increasingly viewed through a strategic lens.17

Taken together — rising nuclear commitments, tightening uranium supply, SMR deployment, and premium geology — the current setup is materially different from past cycles.

For investors looking at where the uranium market is heading, not where it has been, this is why timing matters now.

Talk to your broker about

Refined Energy Corp. (OTC: RRUUF | CSE: RUU) today

Stock Information

OTC: RRUUF

CSE: RUU

Sign up to receive the latest news.

Bringing It All Together

The global energy landscape is undergoing a structural shift. Power demand is rising, nuclear energy is firmly back in long-term planning, and governments are prioritizing secure fuel supply from trusted jurisdictions. Within that framework, uranium has re-emerged as a strategic resource — not just an energy input, but a pillar of energy security.

Against that backdrop, Refined Energy Corp. (OTC: RRUUF | CSE: RUU) offers investors exposure to a uranium-focused company with assets positioned in one of the world’s most established and prolific uranium districts. Its flagship Dufferin Project sits within the Athabasca Basin, a region that has supplied nuclear fuel for decades and continues to play a central role in Western supply chains.

Importantly, this story is not built on short-term speculation. Uranium markets move on long timelines, shaped by policy decisions, utility contracting cycles, and multi-year development paths. Companies aligned with these forces — particularly those operating in stable jurisdictions with established geology — stand to benefit as the next phase of nuclear growth unfolds.

As small modular reactors expand nuclear’s footprint and governments reinforce long-term commitments to baseload power, uranium’s role in the global energy system is becoming increasingly difficult to ignore.

For investors looking to understand where energy security, nuclear policy, and uranium supply intersect, Refined Energy Corp. (OTC: RRUUF | CSE: RUU) represents a company worth further research.

As always, investors should conduct their own due diligence and consider how an opportunity like this fits within their broader investment objectives.

GENERAL NOTICE AND DISCLAIMER – PLEASE READ CAREFULLY THE FOLLOWING NOTICE AND DISCLAIMER MUST BE READ AND UNDERSTOOD AND YOU MUST AGREE TO THE TERMS CONTAINED THEREIN BEFORE USING THIS WEBSITE OR SUBSCRIBING TO OUR NEWSLETTER. We are engaged in the business of advertising and promoting companies. All content on our website is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of www.wallstreetstar.com nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisors, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on wallstreetstar.com. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Wallstreetstar.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website wallstreetstar.com has been retained by an unrelated third party to perform promotional and advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from such third party.

Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability to successfully develop projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons. There is no assurance that Refined Energy Corp. will be successful in achieving a return on shareholders’ investment and the likelihood of success must be considered in light of the [early] stage of operations.

Refined Energy Corp.’s ability to identify Mineral Resources in sufficient quantity and quality to justify development activities and/or its ability to commence and complete development work and/or commence and/or sustain commercial production operations at any of its projects will depend upon numerous factors, many of which are beyond its control, including exploration success, the obtaining of funding for all phases of exploration, development and commercial mining, the adequacy of infrastructure, geological characteristics, metallurgical characteristics of any deposit, the availability of processing technology and capacity, the availability of storage capacity, the supply of and demand for uranium and other minerals, the availability of equipment and facilities necessary to commence and complete development, the cost of consumables and mining and processing equipment, technological and engineering problems, accidents or acts of sabotage or terrorism, civil unrest and protests, currency fluctuations, changes in regulations, the availability of water, the availability and productivity of skilled labour, the receipt of necessary consents, permits and licenses (including mining licenses), and political factors, including unexpected changes in governments or governmental policies towards exploration, development and commercial mining activities.

Furthermore, cost over-runs or unexpected changes in commodity prices in any future development could make the projects uneconomic, even if previously determined to be economic under feasibility studies. Accordingly, notwithstanding the positive results of one or more feasibility studies on the projects, there is a risk that Refined Energy Corp. would be unable to complete development and commence commercial mining operations at one or more of the mineral properties which would have a material adverse effect its business, financial condition, results of operations and prospects.

For a more comprehensive overview of the risks related to Refined Energy Corp.’s business, please review Refined Energy Corp.’s continuous disclosure documents, each filed under the Company’s profile at www.sedarplus.ca.

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Rumble Strip Media Incorporated and its owners, managers, employees, and assigns (collectively “Rumble Strip Media”) has been paid for Refined Energy Corp. (the “Company”) Nine Hundred and Twenty Five Thousand Canadian Dollars (CAD $925,000) plus applicable taxes for an ongoing marketing campaign and is including this article, among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

SHARE OWNERSHIP. The owner of Rumble Strip Media may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities. This relationship and the compensation to be received by us is a major conflict with our ability to be unbiased.

Questions regarding this website may be sent to info@wallstreetstar.com. Some of the content on this website contains forward-looking information within the meaning of Section 27A of the Securities Act of 1993 and Section 21E of the Securities Exchange Act of 1934 including statements regarding expected continual growth of a company and the value of its securities. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 it is hereby noted that statements contained herein that look forward in time which include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources. Wallstreetstar.com makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and wallstreetstar.com has no obligation to update any of the information provided. Wallstreetstar.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Wallstreetstar.com encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content.

Wallstreetstar.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does wallstreetstar.com control, endorse, or guarantee any content found in such sites. Wallstreetstar.com does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that wallstreetstar.com, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that wallstreetstar.com, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Wallstreetstar.com uses third parties to disseminate information to subscribers.

Wallstreetstar.com also places cookies on your computer to allow third party ads to retarget your IP address.. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer: Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information, you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success, and are not responsible for your actions.

References

- 1. https://www.thenationalnews.com/future/technology/ 2025/11/03/power-is-knowledge-how-ai-is-rewriting-the-energy-equation/

- 2. https://www.energy.gov/ne/articles/nuclear-power-most-reliable-energy-source-and-its-not-even-close

- 3. https://www.cruxinvestor.com/posts/us-reinstates-uranium-as-a-critical-mineral-why-this-resets-the-investment-outlook-for-nuclear-fuel

- 4. https://www.eia.gov/todayinenergy/detail.php?id=64444

- 5. https://discoveryalert.com.au/uranium-critical-minerals-status-2025-strategic-shift/

- 6. https://www.cruxinvestor.com/posts/what-you-need-to-understand-about-the-nuclear-sector-before-you-invest-in-uranium---part-2

- 7. https://investingnews.com/us-reinstates-uranium-critical-mineral/

- 8. https://www.visualcapitalist.com/sp/the-global-uranium-market-in-3-charts/

- 9. https://www.energycentral.com/energy-biz/post/openai-ceo-altman-says-future-ai-depends-energy-breakthrough-PumCqEWpu8jh08z

- 10. https://yourstory.com/2023/05/elon-musk-sam-altman-nuclear-energy-future

- 11. https://itif.org/publications/2025/04/14/small-modular-reactors-a-realist-approach-to-the-future-of-nuclear-power/

- 12. https://carboncredits.com/smrs-the-future-of- clean-energy-with-oklo-leading-the-charge-small-modular-reactors/

- 13. https://world-nuclear.org/information-library/country-profiles/countries-a-f/canada-uranium

- 14. https://world-nuclear.org/information-library/country-profiles/countries-a-f/canada-uranium

- 15. https://world-nuclear.org/information-library/country-profiles/others/emerging-nuclear-energy-countries

- 16. https://sprott.com/insights/uranium-s-tale-of-two-markets/

- 17. https://americanaffairsjournal.org/2025/11/the-sovereign-signal-nuclear-energy-as-strategic-infrastructure/