Research: Apex Critical Metals Corp.

OTC: APXCF

CSE: APXC

This is a paid promotion by Apex Critical Metals Corp.

A Global Resource Race Is Underway For The “Next Silicon”

Discover The #1 Company Investors Are Looking At:

Apex Critical Metals (OTC: APXCF, CSE: APXC).

Imagine if you could go back in time and invest in Silicon when it was still unknown…

BEFORE Silicon had ushered in the computer, the smartphone, the internet, and virtually every other product of the “digital age”…

How much wealthier would you be today?

Well, stop imagining, because history is repeating itself. There’s a new ‘miracle metal’ transforming the world.

And the team that’s going to make it happen have done it before in a big way.

CEO Sean Charland is a proven winner with his most recent success story the $300 million takeover of Alpha Lithium. Which, if you were an early investor, would have delivered an 825% return on your investment. Good enough to turn every $1,000 invested into $9,250.

Director’s Jody Dahrogue and Darren L. Smith, led the team that discovered the Patriot Battery Metals Corvette Property – containing the largest lithium pegmatite in the Americas. This discovery led to investors seeing gains as high as 6925% – turning every $1,000 invested into $70,250.

This new ‘miracle metal’ is transforming the world and it’s the latest to grab their attention.

It’s called Niobium and just like Silicon before it, it’s turning science-fiction into reality and enabling next-generation technologies, such as:

And this is just the beginning.

Nobel Prize-winning scientist Stanley Whittingham – the man who invented the lithium-ion battery – backs Niobium to create new cutting-edge batteries.6

It’s clear: the Niobium Age is upon us and it’s transforming the world as we know it.

And make no mistake: this isn’t predicted to happen in ten or fifteen years. This is happening NOW. Which is why Niobium is a metal sought after by major corporations around the world, including:8

But Niobium’s supply has a problem – and that’s precisely why we have a big investment opportunity. Right now, 91% of the world’s niobium comes from a single country: Brazil. But another country – China – has secured control of 26% of Brazil’s production.9 This leaves the United States, the European Union and our allies scrambling to find new sources of this critical metal before it’s too late.

That’s where one little-known company comes in. Apex Critical Metals (OTC: APXCF, CSE: APXC) has just made a game-changing niobium discovery in Canada’s British Columbia.

Their initial surface samples are so promising, they’re drawing comparisons to WA1 Resources – an Australian niobium explorer whose stock shot up 15,885% after a similar find.10

But here’s the thing:

WA1 Resources Niobium find is in Australia – over 9,200 miles away from the countries and companies who desperately need it in Europe and America.12 This makes shipping heavy metals like Niobium expensive and time-consuming.

Whereas Apex Critical Metals (OTC: APXCF, CSE: APXC) doesn’t have this problem. Their find is just a few hours’ drive from the United States border, and is connected to a rail and highway network that stretches to every major market in North America. Which means, they’re the clear front-runner to supply the west with this critical metal.

The good news for you is that Apex Critical Metals (OTC: APXCF, CSE: APXC) is still trading under $1 USD. So you have a brief window of opportunity to position yourself before the mainstream catches on and this stock potentially goes vertical.

Read on to find everything you need to make the right investment decision:

But I urge you to read quickly. Apex Critical Metals (OTC: APXCF, CSE: APXC) is already up over 200%.13 This is just the beginning, but make no mistake, this is a stock on the move.

If you want your piece, you’ll want to make your decision soon. Let’s dive in – starting with the technologies that only Niobium can deliver.

Picture a computer that can solve problems in seconds that would take today’s supercomputers thousands of years. That’s what Quantum Computing is.15

You’ve likely heard about Quantum Computing for years, but its potential has remained just out of reach. The missing link? Niobium – here’s why.

Regular computers are like light switches. Every program they run, website they load, or video they play relies on flipping tiny switches either on (1) or off (0).

But Quantum Computers? They use “magic” switches that can be both on AND off at the same time. This lets Quantum Computers run literally 100-million-times faster than a regular computer.16

The tricky part is keeping this “magic” going long enough to be useful. This is called “coherence”. To bring Quantum Computing into the mainstream, coherence time needs to be at least 0.1 milliseconds. It sounds tiny – but it’s long enough to allow a Quantum Computer to perform thousands of operations.17

Enter Niobium. A recent breakthrough at the USA’s Fermi National Accelerator Laboratory revealed that Niobium-based superconductors can achieve a coherence time of 0.6 milliseconds – six times what’s needed to revolutionize computing!18

In other words, Niobium solves the one problem stopping Quantum Computing from going mainstream. Paving the way for innovations like:

Again, this is all possible because of one incredible metal: Niobium.

Which is why a new report from Fortune Business Insights concludes that the Quantum Computing Market will grow from $1.16 billion today to $12.6 billion by 2032 – a 987% increase.19

It’s no stretch to say that this will lead to surging demand for Niobium – and Apex Critical Metals (OTC: APXCF, CSE: APXC) is perfectly positioned to capitalize on it. But Quantum Computing is only one example of how Niobium is quickly replacing Silicon as the world’s most critical material.

Niobium promises a future where humanity isn’t just reaching for the stars – we’re living among them. Why? Because Niobium overcomes the biggest barrier to mankind becoming a multi-planet species: Earth’s gravity.

You see, to establish a colony on the Moon or Mars, we need to transport vast amounts of water, oxygen, food, and construction materials – millions of kilograms, in fact – beyond Earth’s atmosphere. The challenge? Getting all that material into space is not just hard; it’s expensive.

Which is where Niobium comes in. Because for a rocket to escape the atmosphere with a significant payload, it must meet three critical criteria; it needs to be lightweight, able to withstand extreme temperatures as it breaks out of Earth’s atmosphere, and strong enough to shrug off high structural stress.

Niobium ticks each box. Which is why you’ll find it’s already incorporated into SpaceX’s rockets.20

But it’s not just space exploration we’ll be thanking Niobium for. It’s space mining too. Because we’ll soon transport excavation equipment to gigantic asteroids.

According to the Harvard International Review, mining just the top 10 most cost effective asteroids – out of 6,000 currently being monitored – would generate a profit of $1.5 trillion!21

Space mining will happen within the next ten years, according to industry insiders22– and it will be because Niobium made it possible.

Renewable energy has always promised clean, limitless power at lower costs. Yet, we’re still not there. Niobium is about to change that.

Consider solar power: Niobium-based Perovskite Solar Cells are up to 19% more efficient and 65% cheaper than traditional options. That’s more power for less money.23

Or wind energy: Niobium-reinforced steel makes wind turbine blades lighter and stronger, capturing more energy even in low-wind conditions.

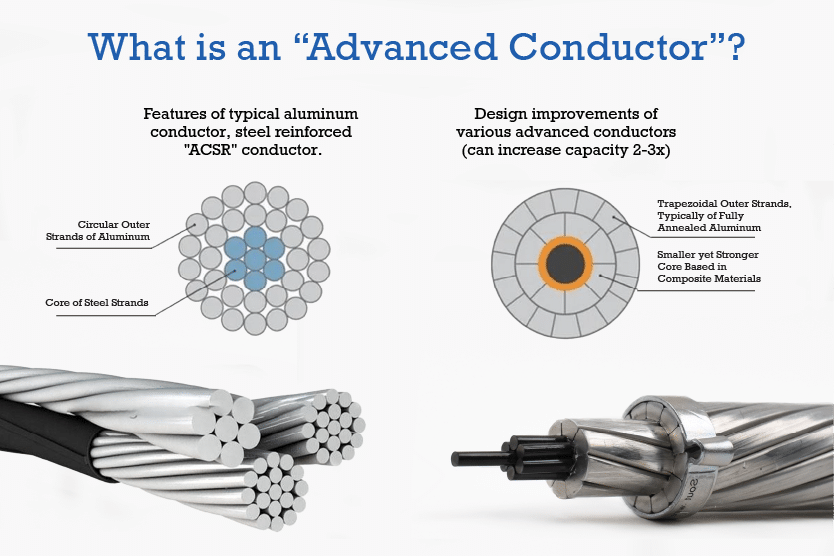

But the real game-changer? Reconductoring.

According to the International Energy Agency, we must add or replace 50 million miles of grids by 2040 globally. (Equal to the amount of grid capacity we have now.)24 That is, if we truly want the future of energy to be renewable.

Part of this is to connect projects like wind power in the North Sea to existing grids. But it also means upgrading existing grids to cope with a growing electricity demand from data centers, electric cars, and exploding populations.

The problem is, building a completely new grid would cost hundreds of billions globally. In the US, it would cost $85 billion. In Germany, $25 billion.25 26 And in the UK, $74 billion.27

But there’s a smarter, faster way: replace old transmission lines with advanced Niobium-infused cables.28 According to industry experts from GridLab, these Niobium-infused cables can carry twice the electricity using the same infrastructure, saving billions and speeding up the transition to renewable energy.29

In other words, Niobium could finally enable renewable energy to surpass fossil fuels as the world’s primary fuel source.

Apex Critical Metals (OTC: APXCF, CSE: APXC) is leading the charge in the "Niobium Age," a metal poised to revolutionize industries like quantum computing, advanced batteries, renewable energy, and deep space exploration.

With 91% of the world’s niobium controlled by Brazil and China, everyone else is left scrambling for new sources. Apex is sitting on a potential multi-billion-dollar deposit, positioning it as a vital player in securing a stable supply.

Apex Critical Metals Corp. (OTC: APXCF, CSE: APXC) has discovered a large carbonatite magnetic anomaly in BC, Canada, with niobium found at the surface. Initial drill holes revealed economically viable concentrations, and a major drilling program is planned for later this year. Apex could follow the successful path set by WA1, a 150x return.

Apex Critical Metals' (OTC: APXCF, CSE: APXC) game-changing Niobium discovery in British Columbia is drawing comparisons to WA1 Resources, whose similar find led to a 15,885% stock increase. Apex’s find is strategically located close to key markets in the US and Europe.

Apex boasts a leadership team with a track record of delivering exceptional returns. CEO Sean Charland is a proven winner with his most recent success story - the $300 million takeover of Alpha Lithium. Good enough to turn every $1,000 invested into $9,250.

Director’s Jody Dahrogue and Darren L. Smith, led the team that discovered the Patriot Battery Metals Corvette Property. This discovery led to investors seeing gains as high as 6925%

The space industry, on its way to becoming a $1.8 trillion sector, relies heavily on niobium. Reusable rockets have made space travel more affordable, but the industry’s success depends on niobium’s strength, heat resistance, and durability to ensure reliable launches.

“The Future is Electric” isn’t just a quote used by American presidents,31 car manufacturers,32 and global financial institutions.33 It’s reality. But this future hinges on better batteries – and once again, Niobium holds the key.

Here’s how:

Again, Niobium-based batteries are backed by Nobel Prize winner, Stanley Whittingham.

Imagine what this means for the future: Cars that need charging only once a week. Electric planes that eliminate jet fuel. Renewable energy stored efficiently, with nothing wasted.

Are you starting to see why the world is rapidly entering the “Niobium Age”? And why Apex Critical Metals (OTC: APXCF, CSE: APXC) could bring you once-in-a-lifetime profits?

If not, then this next one will persuade you.

The most important technology of the Niobium Age will be Hypersonic Missiles. Because these missiles will determine who makes the rules for the next two decades.

For the last two decades, America has enjoyed military supremacy, thanks to its unmatched arsenal of weaponry. As an ally of America, Europe and the West have enjoyed protection and relative stability of America’s supremacy.

But Hypersonic Missiles are now upsetting this status quo. The reason why is that these missiles are so fast, and so maneuverable, that they can evade any known defense system.

See, a typical cruise missile (like America’s Tomahawk missile) will travel around 0.7-times the speed of sound.36 But a hypersonic missile? It travels at least 5-times the speed of sound. Meaning it’s a missile that can strike anywhere on the globe in less than an hour.

Which is why every major country is throwing everything they have into their development. The USA, China, France, Germany, India, Japan, Iran, the United Kingdom, Russia,37 and more have spent at least $10 billion so far – though, given the secretive nature of this weapons program, the true number is likely to be much higher.38

At the heart of each Hypersonic Missile is Niobium. The reason why, is that when a missile travels this fast, the air it’s passing through gets very hot. As discussed earlier, Niobium can withstand extreme temperatures.39 This alone would be a reason why Niobium is the most critical component in Hypersonic Missiles.

But Niobium also has a high strength-to-weight ratio, making it incredibly strong, yet lightweight. Which means the missile can both travel further and carry a larger payload.40

Put simply, there’s no other metal on Earth that can do what Niobium can. But here’s where things get really interesting – and why you should consider adding Apex Critical Metals (OTC: APXCF, CSE: APXC) to your portfolio ASAP.

This battle for future global supremacy is why we’re seeing a global resource grab right now.

As our research has already presented, we’ve discovered that China has already taken ownership of 26% of Brazil’s Niobium supply (equating to 23.4% of the global supply) – with the Brazilian government calling China “an indispensable partner”.41

But the West isn’t just standing by. The European Union has designated Niobium as a ‘critical raw material.’ The USA has ranked it second on its critical minerals list and stockpiles nearly 1.2 million pounds (544,310 kilograms) of it at undisclosed locations across the country.42

Yet while their stockpile may sound large, it’s just a drop in the ocean compared to the 176,320,000 lbs (79,977,406 kilograms) of Niobium used globally, every single year.43

This is why there’s an urgent need for a friendly source of abundant and high-quality Niobium for the West.

But here’s the silver lining – and potentially, the opportunity of a lifetime.

Right now, there’s a race to find and develop new sources of niobium outside of Brazil and China’s control. Not just because of hypersonic missiles, but also because of every next-generation technology that demands Niobium in order to thrive.

And the companies that succeed? They’re not just going to profit. They could literally change the course of history.

So ask yourself: Do you want to be a bystander as we enter the Niobium Age? Or do you want to be part of securing the West’s technological future – and potentially enjoy generational investment profits in the process?

Introducing Apex Critical Metals (OTC: APXCF, CSE: APXC).

Take note of their name. Because as Niobium becomes critical to more technologies, you’ll see them become a household name.

The first thing you need to understand about this company’s potential is that Niobium is extremely hard to find. Like most rare metals, it’s buried deep beneath the Earth and requires extensive drilling to uncover. Which is why geologists turn to two different methods to find it.

The first method involves detecting magnetic anomalies. Niobium is often found alongside magnetite, a magnetic mineral, so geologists search for areas with strong magnetic signatures. Imagine using a giant metal detector to scan a vast area. When they detect a significant magnetic signal, they focus their efforts on that spot, probing deeper to explore its potential.

Now, just because they find a magnetic anomaly doesn’t guarantee there’s Niobium there. Remember; it’s NOT the Niobium which is magnetic – it’s the magnetite. It just makes it more likely that Niobium may be there.

To really be certain, you also need to look for a Thorium anomaly. Thorium is a naturally-occurring radioactive element. And just like magnetite above, it’s often found alongside Niobium. Geologists will use a technique called gamma-ray spectrometry from a plane to find the Thorium – and after they do, they’ll explore further.

Their British Columbia CAP Property sits alongside a proven magnetic anomaly but also within a thorium anomaly as well. Which is a telltale sign that Apex Critical Metals (OTC: APXCF, CSE: APXC) has something special beneath the ground.

The second telltale sign is the results of their drilling program. And get ready, because these numbers will blow your mind.

Typically, a mineral project like this one has something called a “0.2% cutoff”.44 This means that the project needs at least 0.2% of a mineral to be economically viable. Or in other words, 0.2% to make investors a healthy return on their money.

Which is why we’re so bullish on Apex Critical Metals (OTC: APXCF, CSE: APXC). Because from what we’ve seen so far, their Niobium mineral project has the potential to be not just viable – but a cash cow!

Historical holes have demonstrated 0.35% Niobium across 10.42 meters. While more recent drilling revealed 0.51% Niobium over 4.01 meters. Or more than double the economically-viable amount needed to turn a profit.

Yet even these impressive results could end up undershooting the real potential of their property. Because other surface samples have shown Niobium grades ranging from 0.744% all the way to 3.38%!

This is a game-changing find. Not just for the company, their share price, and your investment. But also for the West, who desperately need a source of abundant Niobium in a friendly district.

Apex Critical Metals’ (OTC: APXCF, CSE: APXC) is located just 85km (52 miles) northeast of Prince George city – a city with great transport links to the wider North America. Plus, they’re within easy reach of two major ports to export from. And their property is accessible year-round.45

By this point, we were considering Apex to be one of the most promising stocks we have ever researched. There was just one question remaining.

To answer this question, we looked at a highly comparable property within the same province. This property has very similar magnetic and thorium anomalies. Similar drill results. Similar in every way.

This comparable property is estimated to have as much as 403 million tonnes46 of economically-viable Niobium. If we assume the same for Apex Critical Metals (OTC: APXCF, CSE: APXC) and we use today’s Niobium price of US$45,000 per tonne,47 that’s $18.1 billion in revenue.48

Bottom line, Apex Critical Metals (OTC: APXCF, CSE: APXC) is currently valued at a fraction of their potential.

And we’re 100% confident that the company has the team they need to deliver incredible gains to fast-moving investors. Let’s look at them now:

CEO Sean Charland is a proven winner when it comes to leading resource companies. With over 15 years of experience, his most recent success story is the $300 million takeover of Alpha Lithium. Which, if you were an early investor, would have delivered an 825% return on your investment. Good enough to turn every $1,000 invested into $9,250.49

Director Jody Dahrogue brings over 25 years of experience to the team. He led the consulting team that discovered the Patriot Battery Metals Corvette Property – containing the largest lithium pegmatite in the Americas.50 This discovery led to investors seeing gains as high as 6,912%51 – turning every $1,000 invested into $70,250.

Another director, Darren L. Smith, with 17 years experience, helped to discover the largest rare earth element deposit in the world. And more recently, helped deliver nearly 300% in gains in 6 months for investors.52

The final director, Joness Lang, has a 15-year track record of leading mining projects like the one we’re discussing today. And with one company in particular, American Pacific Mining Corp, he’s helped lead the company to a 470% gain.53

We have analyzed a lot of companies over the past few years. Many companies don’t make the cut. And even of those that do, few have the kind of all-star team that Apex Critical Metals (OTC: APXCF, CSE: APXC) does.

Yet it gets better. Because when it comes to the profit potential here, we don’t have to guess. We have a similar situation to compare to; WA1 Resources. We featured them at the top of this bulletin, however, the story gets more exciting when we take a closer look.

In October 2022, WA1 Resources was trading for pennies. Then they made their P2 discovery and the stock shot up 1,157% in a couple of weeks. But that was just the appetizer. By October 2023 the stock was up 6,928%. And by May 2024, investors had made 15,885%. Good enough to turn every $1,000 into $159,850!54

Apex Critical Metals (OTC: APXCF, CSE: APXC) is following the very same playbook. Right now, they’re trading for pennies – just like WA1 Resources was. Which means every new drilling program, financing, discovery, and extension will be like jet fuel for their share price.

Talk to your broker about Apex Critical Metals (OTC: APXCF, CSE: APXC) today.

Niobium is a hyper-advanced metal shaping the technologies of the future. Countries and corporations are scrambling to find a source of this metal in a friendly jurisdiction. And Apex Critical Metals (OTC: APXCF, CSE: APXC) owns what could be the most abundant source of Niobium in the West.

Plus, when it comes to how high their stock could go, the deck is stacked in your favor. The company boasts a leadership team with a proven track record of multiplying investors’ money. And a very similar company – with a Niobium deposit geographically distant from Europe and North America – has already delivered a 15,885% gain.

To be blunt; Apex Critical Metals (OTC: APXCF, CSE: APXC) is offering you the opportunity of a lifetime. But the window to act is closing fast. As the world wakes up to the Niobium story, as governments scramble to secure supply, as tech firms ramp up demand, the days of this company trading for pennies is coming to an end.

You have a chance to position yourself at the ground floor of what could be the next big resource boom. The question is: Will you seize it? Because in the world of resource investing, fortunes are made by those who act decisively.

The choice is yours. But ask yourself: Can you afford to miss out on what could be the investment opportunity of the next two decades? Can you afford to miss out on the next Silicon.

Don’t be left behind. Don’t spend the next few years kicking yourself for missing out on this once-in-a-generation opportunity.

As the months go by, Niobium will only become more and more mainstream. Just like Silicon is in every device you own, including the one you’re reading this report on, Niobium will soon be just as commonplace.

Apex Critical Metals (OTC: APXCF, CSE: APXC) offers you the chance to get ahead of the world. The chance to grow your investment by multiples. Creating a nest egg that could fund your retirement – and give your children or grandchildren the best start to their adult lives.

Talk to your broker about Apex Critical Metals (OTC: APXCF, CSE: APXC) today.

Investors’ often look to companies with promising mineral projects for outsized returns. The speculative nature of these investments means there’s often big profits on the table with positive drilling results.

In fact, it’s not unusual for companies like Apex Critical Metals (OTC: APXCF, CSE: APXC) to double, triple, even quadruple in a single day based on positive news!

Like most penny stocks, Apex Critical Metals (OTC: APXCF, CSE: APXC) offers you the chance to pick up thousands of shares for a relatively small amount.

So we strongly encourage you to do your due diligence, but consider adding Apex Critical Metals (OTC: APXCF, CSE: APXC) to your speculative portfolio.

For more information, visit the company’s website at https://apexcriticalmetals.com.

GENERAL NOTICE AND DISCLAIMER – PLEASE READ CAREFULLY THE FOLLOWING NOTICE AND DISCLAIMER MUST BE READ AND UNDERSTOOD AND YOU MUST AGREE TO THE TERMS CONTAINED THEREIN BEFORE USING THIS WEBSITE OR SUBSCRIBING TO OUR NEWSLETTER. We are engaged in the business of advertising and promoting companies. All content on our website is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of www.wallstreetstar.com nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisors, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on wallstreetstar.com. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. wallstreetstar.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website wallstreetstar.com has been retained by an unrelated third party to perform promotional and advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from such third party.

Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability to successfully develop projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons. There is no assurance that Apex Critical Metals Corp. will be successful in achieving a return on shareholders’ investment and the likelihood of success must be considered in light of the [early] stage of operations.

Apex Critical Metal’s ability to identify Mineral Resources in sufficient quantity and quality to justify development activities and/or its ability to commence and complete development work and/or commence and/or sustain commercial production operations at any of its projects will depend upon numerous factors, many of which are beyond its control, including exploration success, the obtaining of funding for all phases of exploration, development and commercial mining, the adequacy of infrastructure, geological characteristics, metallurgical characteristics of any deposit, the availability of processing technology and capacity, the availability of storage capacity, the supply of and demand for niobium and other minerals, the availability of equipment and facilities necessary to commence and complete development, the cost of consumables and mining and processing equipment, technological and engineering problems, accidents or acts of sabotage or terrorism, civil unrest and protests, currency fluctuations, changes in regulations, the availability of water, the availability and productivity of skilled labour, the receipt of necessary consents, permits and licenses (including mining licenses), and political factors, including unexpected changes in governments or governmental policies towards exploration, development and commercial mining activities.

Furthermore, cost over-runs or unexpected changes in commodity prices in any future development could make the projects uneconomic, even if previously determined to be economic under feasibility studies. Accordingly, notwithstanding the positive results of one or more feasibility studies on the projects, there is a risk that Apex Critical Metal Corp. would be unable to complete development and commence commercial mining operations at one or more of the mineral properties which would have a material adverse effect its business, financial condition, results of operations and prospects.

For a more comprehensive overview of the risks related to Apex Critical Metal’s business, please review Apex Critical Metal Corp.’s continuous disclosure documents, each filed under the Company’s profile at www.sedarplus.ca.

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Rumble Strip Media Incorporated and its owners, managers, employees, and assigns (collectively “Rumble Strip Media”) has been paid for Apex Critical Metals Corp. (the “Company”) One Million and One Hundred Thousand Canadian Dollars (CAD $1,100,000) plus applicable taxes for an ongoing marketing campaign and is including this article, among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

SHARE OWNERSHIP. The owner of Rumble Strip Media may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities. This relationship and the compensation to be received by us is a major conflict with our ability to be unbiased.

Questions regarding this website may be sent to info@wallstreetstar.com. Some of the content on this website contains forward-looking information within the meaning of Section 27A of the Securities Act of 1993 and Section 21E of the Securities Exchange Act of 1934 including statements regarding expected continual growth of a company and the value of its securities. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 it is hereby noted that statements contained herein that look forward in time which include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources. Wallstreetstar.com makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and wallstreetstar.com has no obligation to update any of the information provided. Wallstreetstar.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Wallstreetstar.com encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content.

Wallstreetstar.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does wallstreetstar.com control, endorse, or guarantee any content found in such sites. Wallstreetstar.com does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that wallstreetstar.com, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that wallstreetstar.com, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Wallstreetstar.com uses third parties to disseminate information to subscribers.

Wallstreetstar.com also places cookies on your computer to allow third party ads to retarget your IP address.. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer: Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information, you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success, and are not responsible for your actions.

©2025 Wall Street Star All rights reserved.