Billions Pour Into Rare Earths as Washington and Wall Street Align

America Moves to Break China’s Grip on Critical Metals

And a rapidly emerging company in America’s heartland could be sitting on the most critical metal in the entire fight…

Stock Information

OTC: APXCF

CSE: APXC

Sign up to receive the latest news.

On July 9, 2025, Washington finally struck back against China’s 20-year stranglehold on the world’s most essential metals.1

For the first time, the U.S. is going all-in and the market reaction has been immediate.

Critical metals stocks are flying.

MP Materials (US: MP) was first. The U.S. government injected $400 million to ramp up production of two essential rare earth elements—and went even further, guaranteeing to buy its output at nearly double the market price.2

Then came Apple, writing a $500 million check and locking in a long-term offtake agreement. The surge of attention sent MP’s stock from $30 to over $76 in just one month.3

Next, NioCorp (US: NB) captured the spotlight. The Department of Defense awarded a $10 million grant to accelerate its Nebraska project.4 Shares jumped 51% in less than a week—and have more than tripled since this wave of U.S. support began.5

This is what happens when money, policy, and national security collide.

And now, the focus is shifting again—toward earlier-stage players with the potential to deliver the next wave of U.S. critical metals supply.

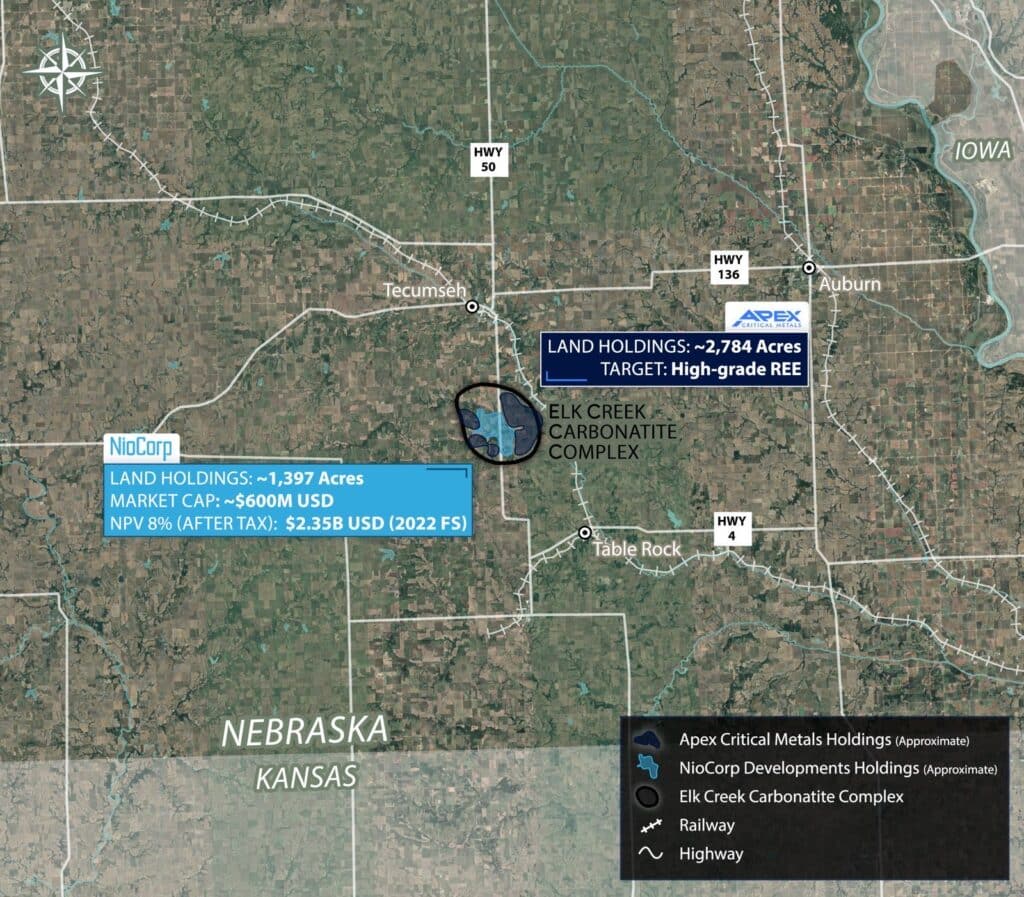

When it comes to critical minerals, location is everything. And Apex Critical Metals (OTC: APXCF, CSE: APXC) is positioned in one of the most strategic spots in America—directly adjacent to NioCorp’s Elk Creek Project.6

NioCorp has already proven Elk Creek to be one of the largest critical mineral deposits containing REE in the U.S.—with backing from the Department of Defense and a valuation north of $850 million

But Apex controls a larger footprint in the same geological system at Elk Creek.

This isn’t a lookalike or a “nearby” prospect. It’s the other half of one of America’s most strategically important mineralized zones.

For over a decade, the Elk Creek Carbonatite Complex rare earth system has been advancing quietly.7 But today, with Washington pouring billions into securing critical metals and national security urgency at an all-time high, the spotlight is shifting.

Now Apex has a chance to follow directly in NioCorp’s footsteps—at a fraction of the valuation—and potentially unlock the next major chapter of America’s rare earth independence.

The Rare Earths That Really Matter

This isn’t just about “rare earths.” It’s about control over the building blocks of modern power.8

These metals drive everything—missile guidance systems, drone motors, EVs, wind turbines, semiconductors, and AI infrastructure. Without them, there’s no modern military, no tech dominance, and no clean energy transition.

For decades, China has controlled nearly the entire global supply chain. But that monopoly is finally under siege.9

Washington is moving fast—pouring billions into new sources, accelerating permitting, and backing U.S. projects with subsidies, loans, and long-term offtake guarantees.

The goal is clear: secure supply, break dependence, and reclaim technological leadership.

"Trump invokes emergency powers to boost US critical minerals production."

– Reuters10

That’s why Apex Critical Metals (OTC: APXCF, CSE: APXC) is built for this exact moment.

Its Elk Creek Rift Project is targeting the rare earths the U.S. needs most—right as national security urgency and corporate demand collide.

With a market cap less than one one-hundredth that of MP Materials, Apex offers investors early exposure to a trend already minting outsized gains for first movers.11

And the Elk Creek Carbonatite Complex may hold something even more valuable—an edge few are talking about. The real prize lies not in the common “light” rare earths, but in a far rarer class: Heavy Rare Earth Elements (HREEs).12

These include dysprosium and terbium—metals that make magnets function under extreme heat and stress. They’re indispensable in advanced defense, aerospace, and semiconductor systems.13 And their prices tell the story:

- Dysprosium: around $200 per pound14

- Terbium: around $900 per pound15

That’s hundreds of times more valuable than bulk metals like copper ($5/lb) or nickel ($7/lb). They are the rarest of the rare earths—the metals global supply chains cannot afford to lose.

And here’s the kicker: U.S. production of these HREEs is virtually nonexistent. Even MP Materials doesn’t have them in sufficient quantities.16

But the Elk Creek Carbonatite might. New data from NioCorp points to a deposit with exactly these strategic metals17—and Apex Critical Metals holds ground right next door.

That puts Apex in a unique position. At a fraction of the size of bigger names like MP Materials and NioCorp, it offers investors ground-floor leverage to the very resources the U.S. military, tech giants, and government are scrambling to secure.

"China spent decades carving out a commanding lead in the rare earth realm. Now the US wants its old piece of the supply chain back…"

– South China Morning Post18

China’s 20 year squeeze play

For more than two decades, China has executed a deliberate squeeze on the rare earths supply chain—from mining at the source, to refining, to the magnet manufacturing that powers modern technology.

Today, more than 85% of the world’s rare earth refining runs through China’s hands.19 That near-monopoly has given Beijing enormous leverage over the global economy, defense capabilities, and the clean energy transition—handing it a strategic weapon without ever firing a shot.

But that dominance is finally being challenged.

Washington has launched an “all-of-the-above” critical minerals strategy—pouring billions into new projects, guaranteeing price floors, accelerating permitting, and securing long-term offtake deals with U.S. producers.20

For investors, it’s a rare ground-floor opportunity to get positioned before the U.S. critical minerals wave lifts the next round of strategic players.

The Elk Creek Carbonatite is emerging as a potential cornerstone of America’s domestic supply chain.

A feasibility study from May 2022 by NioCorp confirmed the deposit hosts an enormous 632,900 metric tons of total rare earth oxides (TREO)—ranking it as the second-largest indicated rare earth resource in the U.S. after Mountain Pass.

Like Mountain Pass, Elk Creek contains significant quantities of neodymium (98,900 metric tons) and praseodymium (26,900 metric tons).

These are the irreplaceable ingredients inside the magnets that drive:

- Electric vehicle motors

- Drones and missile guidance systems

- Wind turbines

- Smartphones and robotics

Sitting immediately adjacent to NioCorp’s Elk Creek Project. Apex Critical Metals (OTC: APXCF, CSE: APXC) is advancing its Elk Creek Rift Project – covering the eastern and western extensions of the very same rare earth system.21

These are the high-value metals critical for:

- Advanced Military equipment

- Aerospace technologies

- Semiconductors

And they are nearly impossible to source outside of China.

Apex’s Ground-Floor Stake in a U.S. Rare Earth Hotspot

Right next door sits Apex Critical Metals (OTC: APXCF, CSE: APXC) advancing the Elk Creek Rift Project, the east and west extensions of this same rare earth system.

This is the other half of one of America’s most strategically important mineralized zones. It’s a U.S.-based carbonatite rare earth system that’s been in the works since 2010, but with today’s national security urgency, it’s finally in the spotlight.

Here’s why it matters:

- It’s massive. Elk Creek is one of the top known rare earth deposits in the country22

- It’s rich. Published data shows high grades of both niobium and total rare earth oxides, making it one of the most valuable critical mineral systems in North America23

- It’s strategic. Apex’s project is exposed to the exact rare earths the U.S. needs most—NdPr for EVs and defense systems, and the rarer, ultra-valuable dysprosium and terbium that global supply chains can’t function without24

- It’s required. In its 2025 draft update, the U.S. Department of the Interior and the U.S. Geological Survey elevated niobium, dysprosium, and terbium into the highest-priority tier of the federal critical minerals list—an urgent ranking reserved for metals with scarce global supply and severe economic risks if disrupted25

Right now, Apex is valued at just $95 million—barely 20 cents on the dollar compared to NioCorp, even though it sits on the same rare earth system in the same U.S. jurisdiction.26

With Washington and the Pentagon throwing weight behind domestic projects, this kind of valuation gap could represent one of the most powerful ground-floor opportunities in the entire sector.

And Apex’s portfolio doesn’t stop there—its CAP Project in British Columbia could unlock even more upside in niobium and rare earths, potentially rivaling billion-dollar Australian discoveries.

The Hidden Niobium Play That Could Be Even Bigger

The CAP Project has the potential to be one of the most significant niobium and rare earth discoveries anywhere in the world.

For proof of just how explosive a niobium discovery can be, look no further than WA1 Resources in Australia.

After confirming a high-grade niobium system, its valuation rocketed to nearly $1 billion—in a fraction of the time most investors expected.27

Now, Apex Critical Metals (OTC: APXCF, CSE: APXC) could be on the verge of a similar story.

Located just 85 kilometers northeast of Prince George, British Columbia, the CAP Project spans a massive 25 square kilometers in a year-round accessible corridor near existing deposits.28

This project has been in the works for over 25 years—quietly building a dataset that now points to something far bigger than previously understood.

And the grades are eye-opening.

- Historical drilling showed 0.35% niobium, already strong by global standards.

- More recent sampling returned 3.33% niobium at surface.

- Multiple additional samples ranged from 0.16% to 0.50% niobium.

- Two large carbonatite boulders returned 1.79% and 1.45% niobium.

These results aren’t isolated—they stretch across a 1.8-kilometer anomaly, with soil and stream concentrate sampling confirming continuity of mineralized carbonatite.

Some samples even revealed 1.21% total rare earth oxides (TREO) alongside high niobium grades—showing CAP may host both critical metals in the same system.

Niobium is one of the world’s rarest and most strategic metals. Only a handful of producers exist globally, and the market is fragile. Prices are climbing as defense, aerospace, and clean energy demand intensify. Every modern jet engine, rocket system, and EV requires it.

With CAP, Apex is one of the few juniors in North America with direct exposure to a potential world-class niobium system.

If drilling confirms what early work is already pointing to, Apex could be sitting on the foundation for a North American niobium supply hub—the kind of asset that majors and governments can’t ignore.

The comparison is obvious: WA1 went from obscurity to a billion-dollar valuation on the back of a single discovery.

Apex, with a market cap around $95 million, could represent one of the most undervalued niobium opportunities in the world today.

And unlike WA1’s Australian project, CAP sits within a long-time U.S. ally, giving it strategic leverage as Washington and Ottawa ramp up critical minerals investment.

This is the kind of hidden asset that can transform a junior overnight. For investors, it’s a sleeper play with the potential to outshine even Elk Creek.

"Niobium is one of the fastest-growing critical metals markets—projected to reach $6.5 billion by 2035, as demand surges from infrastructure, clean energy, and defense.”29

6 Reasons Apex Critical Metals (OTC: APXCF, CSE: APXC) Could Be the Next Big Rare Earths Breakout Star

Reason #1: In the Same Rare Earth Hotspot That Launched NioCorp

Apex is exploring in the exact same Elk Creek geological corridor that propelled NioCorp into the spotlight. That deposit attracted tens of millions in U.S. government funding. Apex now controls ground in the same system— earlier stage, yes, but with far more upside left on the table.

Reason #2: Positioned for the Metals That Win Wars

This is not about generic rare earths. Apex is targeting the elements at the heart of the U.S.–China standoff: neodymium and praseodymium (EV motors, drones, defense magnets) and the ultra-rare dysprosium and terbium (high-heat military, aerospace, and space systems). These heavy rare earths are almost impossible to secure outside China—making Apex’s land even more strategic.

Reason #3: U.S. Government Money Is Pouring In

Washington has gone all-in on critical minerals—committing hundreds of millions in direct funding, guaranteed price floors, and fast-track permitting.

MP Materials and NioCorp have already been rewarded. Apex offers investors exposure to the same system already benefiting from federal momentum, making it a natural candidate for growing interest.

Reason #4: Ground-Floor Value With Asymmetric Upside

MP Materials commands a $13 billion valuation. NioCorp rocketed to $850 million after just a $10 million DoD investment.

Apex? A mere $95 million market cap. That’s the kind of ground-floor leverage where even partial success could translate into outsized returns.

Reason #5: A Direct Stake in America’s Rare Earth Independence

Apex owns the Elk Creek Rift Project—the eastern and western flanks of the same rare earth system NioCorp is advancing.

This isn’t a look-alike; it’s part of the same mineralized structure, with the exact high-value metals—dysprosium and terbium—that Washington is desperate to secure.

Reason #6: Perfect Timing in a Market on Fire

From Apple’s $500 million rare earth investment to the Pentagon’s growing war chest, money is moving fast.

The U.S. is racing to secure supply chains. Apex is sitting in the crosshairs of this geopolitical and technological arms race—right place, right time, right metals.

Do your due diligence, but consider adding Apex Critical Metals (OTC: APXCF, CSE: APXC) to your speculative portfolio.

Stock Information

OTC: APXCF

CSE: APXC

Sign up to receive the latest news.

Why are investors looking at Apex Critical Metals?

The biggest gains are always made by the investors who can spot a super-trend and capitalize on it early. Imagine if you had invested in MP Materials, NioCorp or WA1 before this trend started? Unfortunately, those gains are in the past. But this super-trend has just started and its not too late. Rare Earth Critical Minerals are quickly becoming the most important minerals in the world.

Talk to your broker about

Apex Critical Metals (OTC: APXCF, CSE: APXC) today.

Leading the way

In rare earths, experience isn’t optional—it’s everything. The industry is niche, technically complex, and until recently, overlooked.

Very few professionals have guided projects from discovery through feasibility and into world-class status.

Apex Critical Metals (OTC: APXCF, CSE: APXC) has one of the very best.

His name is Jody Dahrouge—and he is a Founding Director at Apex and President of Dahrouge Geological Consulting. With more than 25 years of exploration success, he has turned overlooked geology into some of the biggest wins in modern mining.30

- NioCorp’s Elk Creek Project: Dahrouge Geological Consulting act as the Qualified Person leading NioCorp’s Elk Creek’s feasibility work—a deposit recognized as one of the largest rare earth resources in the U.S. But here’s the bonus: Apex controls more land in the Elk Creek area than NioCorp itself—including the Elk Creek Rift Project, of the same rare earth system.

- MP Materials (US: MP): At Mountain Pass, Dahrouge was a key figure in revisiting ignored drill targets. That work helped pave the way for MP Materials, now a $13 billion rare earth giant.

- Patriot Battery Metals: His team guided the discovery of the Corvette lithium project, one of North America’s premier lithium assets.

Now, Dahrouge is not only shaping Apex’s Elk Creek Rift strategy but also steering its CAP Project in British Columbia—a niobium-rich carbonatite system that could be even bigger.

Early sampling has returned grades as high as 3.33% niobium, with large-scale anomalies pointing to a deposit that could rival WA1 Resources’ billion-dollar discovery in Australia.

For investors, that’s two world-class shots on goal under the guidance of the same expert who has already helped build MP Materials, NioCorp, and Patriot Battery Metals into industry leaders.

Dahrouge’s presence isn’t just credibility—it’s a signal. He continues to shape Elk Creek’s future, but he’s also chosen to join Apex at the ground floor, bringing the same technical insight and strategic vision that turned overlooked projects into billion-dollar names.

And he isn’t alone. He’s joined by a team of proven operators and market professionals—making Apex one of the most compelling early-stage entries into America’s critical minerals race.31

Sean Charland – CEO

Mr. Charland has over 15 years of experience in capital markets and resource exploration, specializing in raising capital, M&A, and managing public resource companies. Most recently, he was a director of Alpha Lithium, acquired for over $300 million. He also serves as a director at Maple Gold Mines and Core Assets Corp.

Darren L. Smith – Director

Mr. Smith played a leading role in the discovery of both the Ashram REE deposit (2009), one of the world’s largest, and the Corvette lithium district (2017), home to the globally significant CV5 pegmatite. With over 17 years of experience, he brings expertise in complex project management, technical reporting, metallurgical programs, and land management. His focus spans REEs, niobium, scandium, lithium, uranium, and critical industrial minerals.

Joness Lang – Director

Mr. Lang is CEO of Canter Resources, a critical metals explorer in the western U.S., and formerly served as President of American Pacific Mining and EVP of Maple Gold Mines. He has 15 years of experience in corporate growth strategy and capital markets, with a strong track record in acquisitions, JVs, and partnerships including bringing in Agnico Eagle as a strategic partner. His work has earned S&P Global Platts Deal of the Year nominations.

The Ground-Floor Rare Earth Opportunity

You’ve seen this playbook before.

MP Materials (US: MP) soared into a $13 billion rare earth leader.

NioCorp (US: NB) surged from a $100 million explorer to a $850 million developer.

Both were propelled by the U.S. government scramble to secure critical metals and break China’s chokehold on supply chains.

Now comes Apex Critical Metals (OTC: APXCF, CSE: APXC).

Apex controls more land in the Elk Creek rare earth carbonatite than NioCorp—giving it direct exposure to one of America’s most strategically vital mineralized zones.

On top of that, its CAP Project in British Columbia adds a second engine of growth, with niobium samples as high as 3.33% pointing to a potential discovery that could rival WA1 Resources’ billion-dollar breakout in Australia.

And Apex isn’t chasing just any metals. It’s after Dysprosium and Terbium—the heavy rare earths essential for high-heat defense and aerospace systems, worth over 100x copper or nickel.

At a $95 million valuation, Apex trades at a fraction of its peers, in the right place, at the right time, with the right team.

The U.S. critical minerals wave is just beginning. The winners are moving early. And this is the moment to take a hard look at Apex Critical Metals (OTC: APXCF, CSE: APXC) before the market catches on.

GENERAL NOTICE AND DISCLAIMER – PLEASE READ CAREFULLY THE FOLLOWING NOTICE AND DISCLAIMER MUST BE READ AND UNDERSTOOD AND YOU MUST AGREE TO THE TERMS CONTAINED THEREIN BEFORE USING THIS WEBSITE OR SUBSCRIBING TO OUR NEWSLETTER. We are engaged in the business of advertising and promoting companies. All content on our website is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of www.wallstreetstar.com nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisors, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on wallstreetstar.com. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. wallstreetstar.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website wallstreetstar.com has been retained by an unrelated third party to perform promotional and advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from such third party.

Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability to successfully develop projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons. There is no assurance that Apex Critical Metals Corp. will be successful in achieving a return on shareholders’ investment and the likelihood of success must be considered in light of the [early] stage of operations.

Apex Critical Metal’s ability to identify Mineral Resources in sufficient quantity and quality to justify development activities and/or its ability to commence and complete development work and/or commence and/or sustain commercial production operations at any of its projects will depend upon numerous factors, many of which are beyond its control, including exploration success, the obtaining of funding for all phases of exploration, development and commercial mining, the adequacy of infrastructure, geological characteristics, metallurgical characteristics of any deposit, the availability of processing technology and capacity, the availability of storage capacity, the supply of and demand for niobium and other minerals, the availability of equipment and facilities necessary to commence and complete development, the cost of consumables and mining and processing equipment, technological and engineering problems, accidents or acts of sabotage or terrorism, civil unrest and protests, currency fluctuations, changes in regulations, the availability of water, the availability and productivity of skilled labour, the receipt of necessary consents, permits and licenses (including mining licenses), and political factors, including unexpected changes in governments or governmental policies towards exploration, development and commercial mining activities.

Furthermore, cost over-runs or unexpected changes in commodity prices in any future development could make the projects uneconomic, even if previously determined to be economic under feasibility studies. Accordingly, notwithstanding the positive results of one or more feasibility studies on the projects, there is a risk that Apex Critical Metal Corp. would be unable to complete development and commence commercial mining operations at one or more of the mineral properties which would have a material adverse effect its business, financial condition, results of operations and prospects.

For a more comprehensive overview of the risks related to Apex Critical Metal’s business, please review Apex Critical Metal Corp.’s continuous disclosure documents, each filed under the Company’s profile at www.sedarplus.ca.

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Rumble Strip Media Incorporated and its owners, managers, employees, and assigns (collectively “Rumble Strip Media”) has been paid for Apex Critical Metals Corp. (the “Company”) One Million, Eight Hundred Thousand Canadian Dollars (CAD $1,800,000) plus applicable taxes for an ongoing marketing campaign and is including this article, among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

SHARE OWNERSHIP. The owner of Rumble Strip Media may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities. This relationship and the compensation to be received by us is a major conflict with our ability to be unbiased.

Questions regarding this website may be sent to info@wallstreetstar.com. Some of the content on this website contains forward-looking information within the meaning of Section 27A of the Securities Act of 1993 and Section 21E of the Securities Exchange Act of 1934 including statements regarding expected continual growth of a company and the value of its securities. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 it is hereby noted that statements contained herein that look forward in time which include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources. Wallstreetstar.com makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and wallstreetstar.com has no obligation to update any of the information provided. Wallstreetstar.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Wallstreetstar.com encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content.

Wallstreetstar.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does wallstreetstar.com control, endorse, or guarantee any content found in such sites. Wallstreetstar.com does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that wallstreetstar.com, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that wallstreetstar.com, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Wallstreetstar.com uses third parties to disseminate information to subscribers.

Wallstreetstar.com also places cookies on your computer to allow third party ads to retarget your IP address.. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer: Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information, you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success, and are not responsible for your actions.

References

- 1. https://mpmaterials.com/news/mp-materials-announces-transformational-public-private-partnership-with-the-department-of-defense-to-accelerate-u-s-rare-earth-magnet-independence/

- 2. https://ca.finance.yahoo.com/news/exclusive-trump-administration-expand-price-194748239.html

- 3. https://ca.finance.yahoo.com/quote/MP/

- 4. https://www.niocorp.com/u-s-department-of-defense-awards-up-to-10-million-to-niocorps-subsidiary-elk-creek-resources-corp/

- 5. https://ca.finance.yahoo.com/quote/NB/

- 6. https://www.niocorp.com/elk-creek-project/elk-creek-project-critical-minerals/

- 7. https://www.srk.com/en/projects/elk-creek-mine-mineral-resources

- 8. https://www.washingtonpost.com/opinions/2025/ 08/04/trump-tariffs-china-trade/

- 9. https://www.washingtonpost.com/opinions/2025/08 /04/trump-tariffs-china-trade/

- 10. https://www.reuters.com/world/trump-says-us-sign-minerals-deal-with-ukraine-shortly-2025-03-20/

- 11. https://thecse.com/listings/apex-critical-metals-corp/

- 12. https://www.csis.org/analysis/consequences-chinas-new-rare-earths-export-restrictions

- 13. https://asm-au.com/metals/products/dy-tb-metals/

- 14. https://strategicmetalsinvest.com/dysprosium-prices/

- 15. https://strategicmetalsinvest.com/terbium-prices/

- 16. https://www.energypolicy.columbia.edu/mp-materials-deal-marks-a-significant-shift-in-us-rare-earths-policy/

- 17. https://www.sciencedirect.com/science/article/pii/ S016913682200261X

- 18. https://www.scmp.com/economy/global-economy/article/3320805/us-its-mountain-pass-or-fail-bid-supplant-chinas-rare-earth-supremacy

- 19. https://www.polytechnique-insights.com/en/columns/geopolitics/china-has-a-monopoly-on-rare-earths/

- 20. https://ca.finance.yahoo.com/news/exclusive-trump-administration-expand-price-194748239.html

- 21. https://www.metaltechnews.com/story/2022/05/25/tech-metals/elk-creek-deposit-proves-to-be-rare-earth/947.html

- 22. https://investingnews.com/daily/resource-investing/critical-metals-investing/rare-earth-investing/why-niocorps-elk-creek-niobium-project-is-worth-a-look/

- 23. https://www.niocorp.com/niocorp-to-review-potential-of-adding-rare-earths-to-its-currently-planned-critical-minerals-product-offering/

- 24. https://www.metaltechnews.com/story/2025/09/03/tech-metals/elk-creek-minerals-in-top-us-urgency-list/2463.html

- 25. https://www.metaltechnews.com/story/2025/09/03/tech-metals/elk-creek-minerals-in-top-us-urgency-list/2463.html

- 26. https://ca.finance.yahoo.com/quote/NB/

- 27. https://ca.finance.yahoo.com/quote/WA1.AX/

- 28. https://apexcriticalmetals.com/projects/cap-project/

- 29. https://www.researchnester.com/reports/niobium-market/3073?utm_source.com

- 30. https://apexcriticalmetals.com/company/

- 31. https://apexcriticalmetals.com/company/